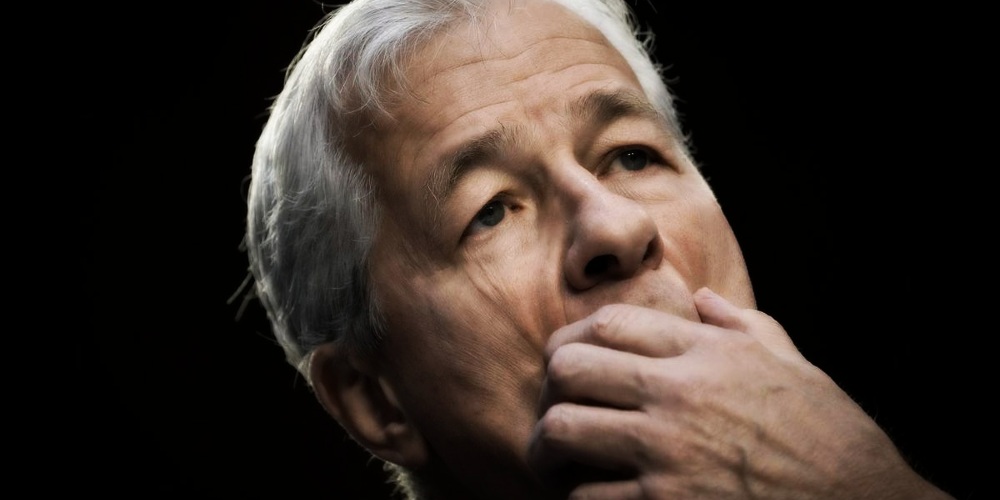

JPMorgan CEO Jamie Dimon, predicts rough times ahead for regional banks and warns of more deposit runs, as future interest rate hikes become increasingly likely.

Dimon warned at a May 22 Q&A Investor Day meeting at JPMorgan Chase that interest rates were likely to go higher from here and rise to as much as 7 percent.

He noted that there was much uncertainty about the health of regional banks and that rising yields in the money market have led to a steady outflow of deposits, bringing their balance sheets to dangerous levels.

A combination of Federal Reserve rate hikes and quantitative tightening is adding more fuel to the regional bank crisis. JPMorgan controls more than 13 percent of the nation’s deposits, with a lock on 21 percent of all credit card spending.Under Dimon, the banking giant has gobbled up more of the lending market with each small bank failure, since the financial […]

Excerpt Sourced From: ourgoldguy.com